The Reserve Bank of India (RBI) announced its plan to purchase government securities worth Rs 1.25 lakh crore through open market operations (OMO) in the month of May. This decision aims to maintain orderly liquidity conditions in the system, with the central bank reiterating its commitment to monitor the market and take necessary measures. The bond purchase will be divided into four tranches, with detailed instructions to be released separately for each tranche. Stay updated on the latest business news and stock market updates through Zee Business.

A leader of Karni Sena, a Rajput caste-based organization, has been booked for offering a bounty of Rs 25 lakh to anyone who kills Samajwadi Party MP Ramji Lal Suman. The accused, Mohan Chauhan, made the announcement following Suman's controversial remark on a 16th-century Rajput king. The incident came to light after a complaint was filed by the SP Mahila Sabha chief at a police station in Aligarh. The police transferred the case to another station and have started an investigation. Stay updated with NDTV for the latest news from India and across the globe.

With the price of gold constantly fluctuating, many investors are turning to Gold ETFs as a more convenient and cost-effective way to invest in the precious metal. In this article, we explore the top 5 Gold ETFs with the highest annualised returns in the past 10 years and analyze their performance since their debut in the market. Find out how a one-time investment of Rs 1,25,000 in each fund has fared over a 10-year period, with an expense ratio as low as 0.41 per cent.

According to a recent report from the Comptroller and Auditor General of India, the now-scrapped liquor policy implemented by the Delhi Government has resulted in a revenue loss of about Rs 2,002 crore. This includes approximately Rs 890 crore due to not retendering surrendered retail licenses and Rs 941 crore due to exemptions given to zonal licensees. The 166-page report also highlights the incorrect collection of security deposits and the lack of important measures such as liquor testing labs and rigorous quality assurance, leading to CM Arvind Kejriwal and his deputy Manish Sisodia facing legal action and resigning from their posts.

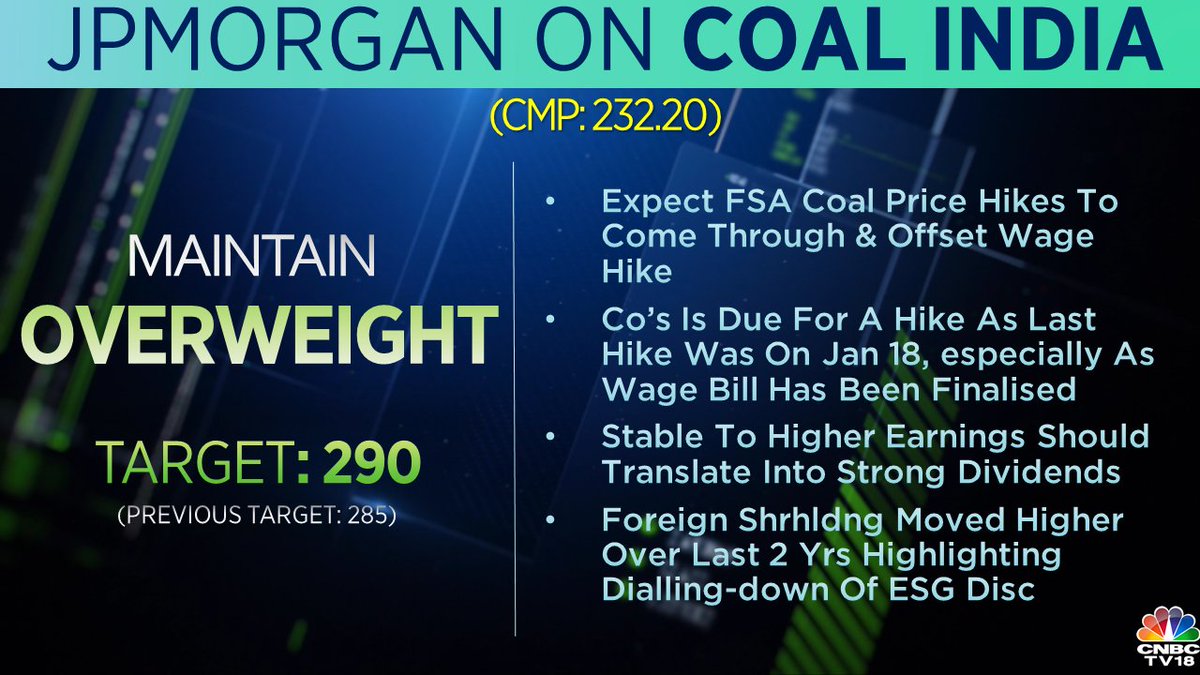

JPMorgan's recent downward revision of Coal India's target price highlights concerns over weakening international coal prices, sluggish domestic power demand, and intense market competition. These factors have led to a decline in the company's margins and profits, causing a negative impact on the stock's performance. While government policies and demand revival may offer some respite, investors are proceeding with caution amidst uncertain market conditions. Stay up-to-date on the latest business news and market updates on Zee Business.

Vivo has revealed the design and key specifications for its upcoming V50 smartphone, which will feature Zeiss optics and three color options. The device will also come with Schott Diamond Shield Glass for added drop protection and will run on Android 15 with "Smart AI" features. Though the charging speed is not yet confirmed, leaks suggest that the V50 will be powered by the Snapdragon 7 Gen 3 Chipset and have up to 12GB of RAM and 512GB of storage. The official launch date is yet to be announced, but the device is expected to be priced in the range of Rs 30,000 to Rs 40,000. Stay tuned for our coverage on the latest tech news and reviews.

With the announcement of the new tax regime, Finance Minister Nirmala Sitharaman has announced significant changes to the slabs and rates to benefit all taxpayers. Under the new system, taxpayers with normal income up to Rs 12 Lakhs will not have to pay any taxes, and those with income up to Rs 4 Lakhs will be exempted. The time limit for filing returns has also been extended to 4 years.

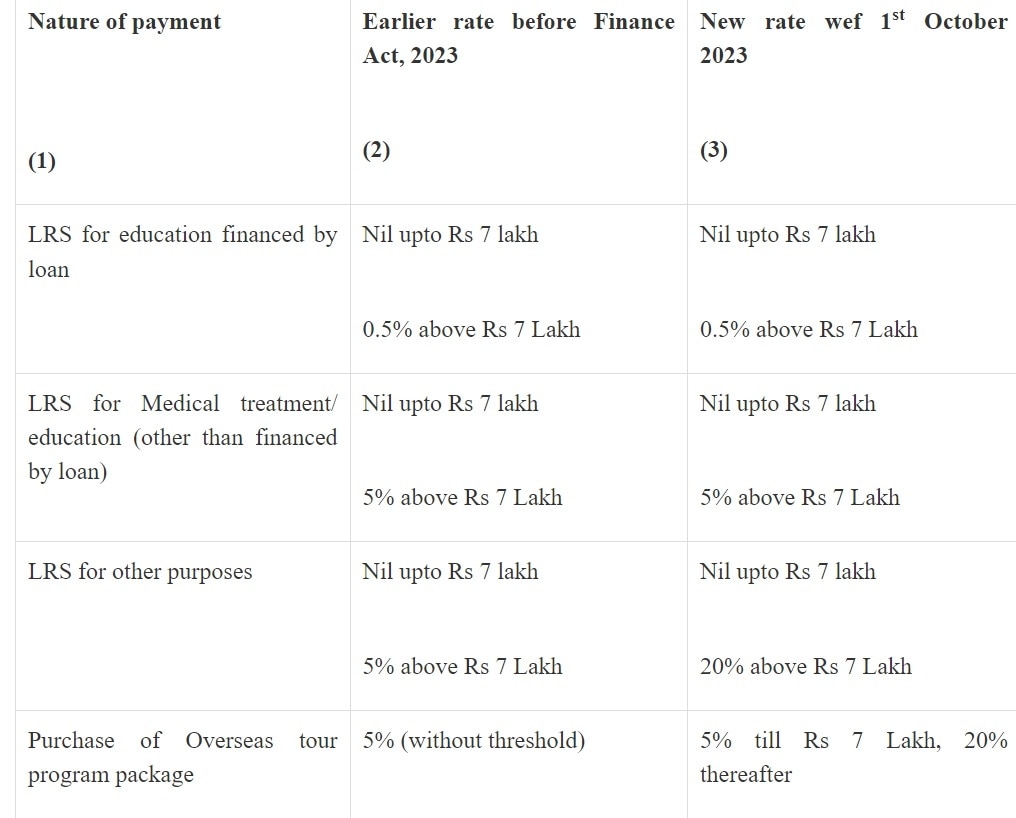

Finance Minister Nirmala Sitharaman has proposed to increase the threshold for collecting TCS on Liberalised Remittance Scheme transactions from Rs 7 lakh to Rs 10 lakh. This move is expected to benefit the travel and foreign exchange sectors, providing a boost to outbound tourism, education, and the airline industry. Experts say this hike in TCS threshold will also ease the burden on students and individuals seeking medical treatment abroad. Additionally, the Finance Minister's second Budget for the BJP government focuses on various sectors to revive the struggling Indian economy.

The Indian government has announced a new Fund of Funds Scheme (FFS) with a corpus of Rs 10,000 crore to support the growth of startups in the country. The scheme, operationalized by the Small Industries Development Bank of India (SIDBI), provides capital to registered alternative investment funds (AIFs) that in turn invest in startups. With commitments of over Rs 91,000 crore from AIFs, the government plans to further expand the scheme with an additional contribution of Rs 10,000 crore. The AIFs supported by the scheme include prominent names such as Chiratae Ventures, India Quotient, Blume Ventures, and JM Financial.

In a major move, the finance minister has announced an increase in the income tax rebate limit from Rs 7 lakh to Rs 12 lakh, providing significant savings for high earners. However, for those earning above Rs 12 lakh, taxes will be applicable as per slab rates under the new tax regime, with a 5% tax on income between Rs 4 lakh to 8 lakh, 10% on income between Rs 8 lakh to 12 lakh, and 15% between Rs 12 lakh to 16 lakh. The FM has also proposed a sharp cut in tax rates for incomes between Rs 15 lakh and Rs 24 lakh, with the 30% rate now only applicable for income above Rs 24 lakh.