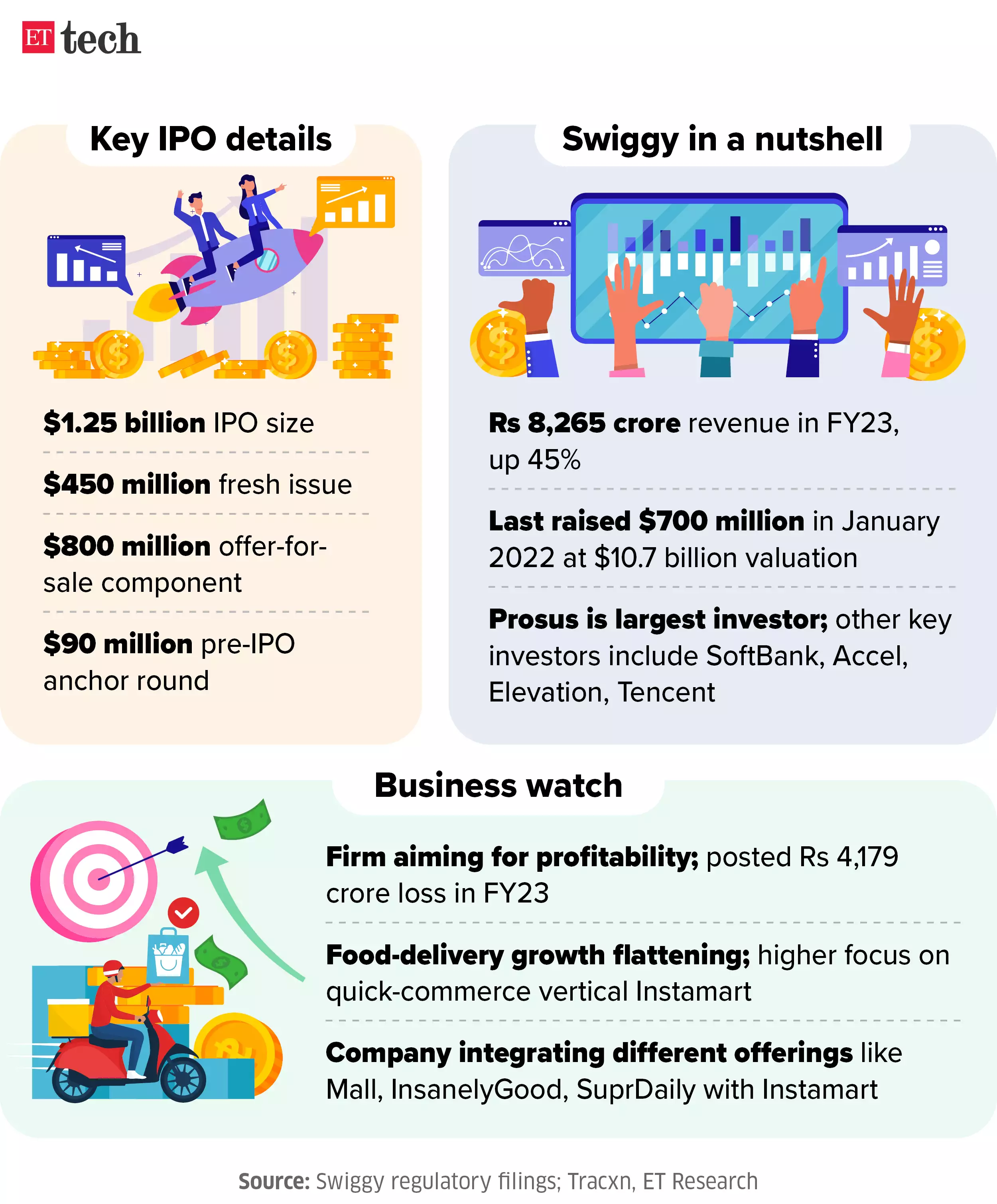

The food and grocery delivery company Swiggy Ltd is set to debut on the stock exchanges with an initial public offering of Rs 11,300 crore, making it the second-largest issue in the primary markets this year. Analysts are predicting that Swiggy's shares may see a flat or negative listing, and are advising investors who have not been allotted shares to wait for the share price to settle before buying. Despite being a major player in the e-commerce and food delivery market, Swiggy's IPO received a sluggish response, with concerns over its negative cash flow business model and high competition leading to lackluster interest from non-institutional investors and retail investors.

Swiggy's Bumpy IPO Debut: A Detailed Analysis

Background

An initial public offering (IPO) is a process whereby a private company offers its shares to the public for the first time. The company raises capital by selling these shares, which subsequently become available for trading on the stock market.

Swiggy's IPO Journey

Swiggy, India's leading food and grocery delivery company, launched its IPO on March 17, 2023, with an aim to raise Rs 11,300 crore. The offer received a lukewarm response, with concerns raised about Swiggy's negative cash flow business model and intense competition.

IPO Performance

Despite being a major player in the e-commerce sector, Swiggy's IPO witnessed a flat to negative listing on both the BSE and NSE. Shares opened at a premium of just 1-2% before declining slightly. Analysts attributed this performance to concerns about the company's profitability and intense competition.

Top 5 FAQs

1. Why did Swiggy's IPO receive a subdued response?

2. What is Swiggy's financial performance?

3. What are the key challenges faced by Swiggy?

4. What is the outlook for Swiggy?

5. Should investors buy Swiggy shares after the IPO?

Aditya Birla Sun Life Insurance has introduced their new Dividend Yield Fund, available through their existing ULIPs, which will primarily invest in top dividend-paying companies in India. The fund aims to provide steady and consistent value creation through a mix of equities and debt instruments. This move reflects Aditya Birla Sun Life Insurance's commitment to balancing protection and performance for their policyholders, allowing them to achieve their long-term financial goals with confidence in a stable market environment.

Blackstone, a major asset manager, has announced plans to invest $1.2 billion in building a new power plant in West Virginia to meet surging electricity demand from artificial intelligence and industrial growth. The 600-megawatt plant will be funded by utilities and large investors, and will supply power to Old Dominion Electric Cooperative, serving 1.5 million residents. Blackstone's senior managing director says the investment aligns with their focus on meeting the increasing demand for electricity from AI and other industries. This is just the latest in Blackstone's recent energy investments, totaling over 1,600 megawatts of new gas-fired capacity.

Efforts to ease tensions between Pakistan and Afghanistan came to a standstill during peace talks in Istanbul, with both sides pointing fingers at each other for the breakdown. In a press conference, Afghan delegation leader Mullah Najib shared that Pakistan demanded a fatwa against the Tehreek-e-Taliban Pakistan (TTP) from the Taliban's Supreme Leader. He stated that such a decision should be made by the Dar al-Ifta, a religious authority in Afghanistan, in response to a written request from Pakistan's government. This comes as Pakistan has repeatedly accused Afghanistan's Taliban rulers of supporting the TTP, a militant group responsible for attacks inside Pakistan.

After months of anticipation and restructuring, Tata Motors Commercial Vehicles Ltd (TMCVL) is finally set to debut on the Indian stock exchanges today. As part of the demerger process, the commercial vehicle (CV) business has now been renamed Tata Motors and will operate as a separate entity. Experts are expecting a strong debut for the company's shares, with a potential listing price range of Rs 300-350 per share. Investors will have to exercise caution, as the stock will initially be in the trade-for-trade segment to ensure smooth price discovery.

Indian equity benchmark indices, the Sensex and Nifty, started the session in the green on Wednesday with a significant increase backed by positive global cues. Shares of the commercial vehicle business of Tata Motors will start trading today after their debut on the bourses. With major players like Eternal and Bajaj Finserv leading the pack, the markets saw a mixed response from different sectors. Foreign Institutional Investors offloaded equities while Domestic Institutional Investors bought stocks, shaping market trends for the day. Broader Asian equities and the US markets also showed mixed signs.

Economic Offences Wing conducts raids on an assistant manager of Primary Agricultural Credit Co-operative Society in Madhya Pradesh and uncovers movable and immovable assets worth crores of rupees. The EOW had received a complaint regarding alleged corruption by the manager, leading to the registration of an FIR. The team finds that the manager acquired these assets in his and his family members' names in the past 10 years, despite only receiving a salary of Rs 50 lakh in his 15 years of service. Investigation is ongoing into the purchase of bank accounts, lockers, and agricultural land by the manager.

The Deputy Commissioner of Pulwama, Dr. Basharat Qayoom, recently chaired a review meeting to assess the progress of the PM Surya Ghar Muft Bijli Yojana in the district. Detailed presentations were given on the achievements and current status of the scheme, with a focus on expediting the installation of rooftop solar systems and streamlining the bank loan process. The importance of active coordination between KPDCL, vendors, and banking partners was emphasized, along with the need for a public outreach campaign to promote the long-term benefits of the initiative.

The Bheem Bhai Tribal Women's Cooperative Society in Utnoor is revolutionizing the idea of women's economic empowerment by producing high-quality and nutritious Ipappuvvu laddus, a traditional delicacy made from locally sourced ingredients. With an annual turnover of Rs.1.27 crore, the society not only benefits 100 tribal families but also supplies laddus to 77 tribal residential schools and sells them in the open market. The success of the cooperative has been recognized by Minister Danasari Anasuya and Prime Minister Narendra Modi, highlighting the impact of women-led economic transformation in tribal areas.

TTD's Additional Executive Officer, Ch Venkaiah Chowdary, conducted a meeting to review feedback from devotees regarding various amenities provided by TTD in Tirumala. The meeting included discussions on queue management, food services, sanitation, and price control. The TTD also introduced a potential parking solution, presented by Gopark Technology Private Limited, to make parking in Tirumala more efficient and convenient for devotees.

The Securities and Exchange Board of India (SEBI) has cautioned investors against investing in digital or e-gold products, which fall outside its regulatory framework. The regulator clarified that such products are not notified as securities or regulated as commodity derivatives, and therefore do not have the same investor protection mechanisms in place. SEBI recommends investing in regulated gold products, such as Gold Exchange Traded Funds (ETFs) and Electronic Gold Receipts, which are governed by its regulatory framework and can be accessed through registered intermediaries.