China's Geological Bureau of Hunan Province has announced a groundbreaking discovery of a massive gold reserve in the Wangu gold field, with an estimated value of £66 billion. The deposit, believed to contain up to 1,100 metric tonnes of gold, has sparked a surge in gold prices and will have significant implications for both domestic and global markets. However, experts caution that the find will only partially address China's high gold consumption needs and will still require substantial imports. Stay updated on all the latest tech and gadget news on Gadgets 360, and don't forget to follow our in-house influencers, Who'sThat360, on Instagram and YouTube.

China's Gold Discovery: A Game-Changer in Global Markets

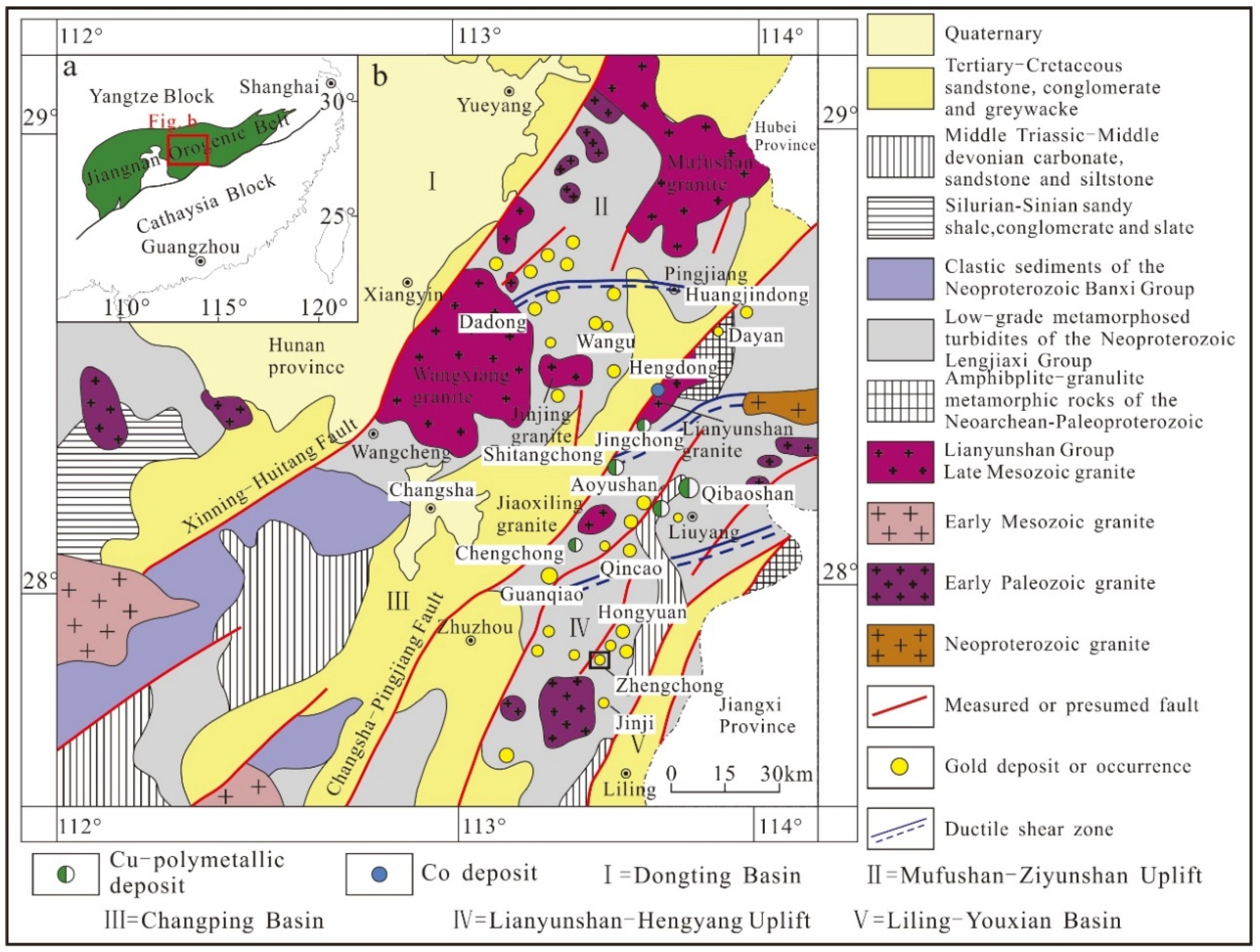

China has recently made a groundbreaking discovery of a massive gold reserve in Hunan Province, marking a significant milestone in the global gold industry. The Wangu gold field, estimated to contain up to 1,100 metric tonnes of gold, has sparked a surge in gold prices and is projected to have far-reaching implications for domestic and international markets.

Background

China has long been a major consumer of gold, primarily for jewelry and investment purposes. Despite being the world's largest gold producer, China has relied on imports to meet its high domestic demand. The discovery of the Wangu gold reserve is expected to reduce China's reliance on external sources and bolster its position as a major player in the global gold trade.

Impact on Gold Prices

The announcement of the Wangu gold reserve has sent shockwaves through the international gold markets. Prices have risen sharply as investors anticipate a potential supply increase in the future. The discovery has also raised concerns about the long-term stability of gold prices.

Implications for Chinese Economy

The Wangu gold reserve is a major economic boost for China. The estimated value of £66 billion could significantly contribute to the country's GDP and foreign exchange reserves. The discovery is also expected to create jobs and stimulate economic growth in the Hunan Province.

Implications for Global Markets

The discovery of the Wangu gold reserve is likely to have a multifaceted impact on global markets. Reduced demand from China could ease upward pressure on gold prices, benefiting consumers and investors alike. However, the long-term effects on the global gold supply chain and prices remain uncertain.

Top 5 FAQs and Answers

How much gold is in the Wangu gold field?

What is the impact on gold prices?

How will China benefit from the discovery?

What are the implications for global markets?

Has China made any other major gold discoveries in the past?

The Securities and Exchange Board of India (SEBI) has cautioned investors against investing in digital or e-gold products, which fall outside its regulatory framework. The regulator clarified that such products are not notified as securities or regulated as commodity derivatives, and therefore do not have the same investor protection mechanisms in place. SEBI recommends investing in regulated gold products, such as Gold Exchange Traded Funds (ETFs) and Electronic Gold Receipts, which are governed by its regulatory framework and can be accessed through registered intermediaries.

In a review meeting held at the SPRH meeting hall in Tirumala, TTD's additional executive officer, Ch. Venkaiah Chowdary, examined pilgrim feedback on various amenities and services. Acting on the Chief Minister's directive, TTD has been collecting feedback through multiple channels and Chowdary stressed the importance of implementing suggestions for continuous improvement. The meeting also saw a presentation from Gopark Technology Pvt Ltd on a smart parking management proposal aimed at reducing congestion.

As the modern work culture takes a toll on employees' mental and emotional health, Gen Z professionals are leading the charge for a new approach to work-life balance. Dubbed "micro-retiring," this trend involves taking short, independent breaks to rest, recharge, and refocus, rather than resigning or taking a sabbatical mid-career. While this trend empowers individuals to prioritize their well-being, experts highlight the importance of careful planning to ensure financial stability and avoid burnout. With mental health now in the spotlight, micro-retiring is becoming a legitimate and popular choice for young professionals seeking a more fulfilling and balanced life.

The Indian stock market started the day on a negative note, with the Sensex and Nifty both opening in the red. This was due to weak global cues, with the BSE Sensex shedding 160.86 points and the Nifty falling 75.9 points in early trading. However, some stocks showed positive performance, with Eternal leading the pack. Meanwhile, Nifty 50's early indicator Gift Nifty indicated a positive start for the day. The previous day, Foreign Institutional Investors were net sellers while Domestic Institutional Investors bought equities.

The Telangana Southern Power Distribution Company Limited (TGSPDCL) has introduced "Currentolla Praja Baata" in Nalgonda, Medak, Mahabubnagar, Ranga Reddy, and Hyderabad, aimed at enhancing power distribution in the region. Led by CMD Musharraf Faruqui, the initiative will involve over 9,500 employees who will personally visit different areas to interact with consumers and address complaints. This program hopes to minimize power losses, strengthen the network, and improve the quality and reliability of power supply in Telangana.

A new Randstad India report reveals insights about India's youngest workforce cohort and their expectations for their careers. Gen Z prioritizes financial security, flexibility, and a sense of purpose in their job, requiring employers to go beyond just providing a decent salary. With a preference for a combination of a full-time job and a side hustle, Gen Z's mobility is driven by the pursuit of growth, making it crucial for employers to invest in continuous learning and foster inclusive cultures to retain this transformative generation.

According to Randstad India's latest report, young professionals in India are redefining workplace norms by prioritizing factors like pay, flexibility, and personal values. The report also reveals that Gen Z values continuous learning through AI tools and is more concerned about the impact of AI on job security. This calls for businesses to adapt to changing preferences and attract the next generation of talent by offering a mix of technical excellence and personal autonomy. The findings also emphasize the need for inclusive cultures and flexible policies in order to build resilient, future-ready businesses.

With the Gen-Z workforce making up about 27% of India's population, companies are struggling to retain this energetic cohort. A recent report by Randstad highlights the need for a change in mindset from employers towards the Gen-Zs. While they have long-term aspirations, they are also quick to move on to new opportunities if they feel undervalued or underpaid. This poses a challenge for employers who must find ways to keep this ambitious and driven generation engaged and progressing within their organizations.

Union Home Minister and Minister of Cooperation, Amit Shah, congratulated Amul and Indian Farmers Fertiliser Cooperative Limited (IFFCO) for securing the first and second ranks in the global ranking for cooperatives. This achievement is a testament to the boundless potential of cooperatives, which are being transformed into a global model of empowerment and self-reliance by Prime Minister Narendra Modi. The dairy sector, which is the backbone of rural livelihoods in India, has combined farmer-led cooperatives, women's participation and scientific practices to achieve remarkable progress. Additionally, the National Co-operative Exports Limited, set up by the government, has achieved a significant milestone in exporting agricultural commodities.

After purchasing his retirement property in Swansea, David Barlow has been forced to live in a motorhome on his driveway due to persistent damp and mould issues. Despite complaints to his property managers, the issue has not been resolved and Barlow fears for his belongings. The problem is believed to have been caused by faulty insulation installed by British Gas, but the company denies responsibility. This situation has put a hold on Barlow's retirement plans and has left him feeling frustrated and stuck.