Mumbai-based health-tech startup, Watch Your Health, announced today that it has raised $5 million in a Series A funding round co-led by Cornerstone Ventures and Conquest Global. The company plans to use the funds to expand its operations and user base, and enhance its technological capabilities. Co-founded in 2015, Watch Your Health serves in the B2B space, providing insurers and pharmaceutical companies with advanced analytics and personalized recommendations for their customers to improve their health. The company also aims to introduce new features such as electronic behavior records, mental health support, and advanced predictive analytics to prevent diseases and manage chronic conditions. Stay updated with the latest business news, stock market updates, and more through Zee Business's coverage, and save money with their personal finance coverage and income tax calculator. Follow Zee Business on Twitter, Facebook, and YouTube for live business updates.

Watch Your Health Raises $5 Million in Series A Funding

Background

Watch Your Health is a Mumbai-based health-tech startup founded in 2015. The company operates in the B2B space, providing advanced analytics and personalized recommendations to insurers and pharmaceutical companies to help their customers improve their health.

Funding Round

On January 12, 2023, Watch Your Health announced that it had raised $5 million in a Series A funding round co-led by Cornerstone Ventures and Conquest Global. The company plans to use the funds to expand its operations and user base, and enhance its technological capabilities.

Expansion Plans

Watch Your Health plans to use the funding to expand its operations in India and abroad. The company also aims to develop new features, such as electronic behavior records, mental health support, and advanced predictive analytics. These features are designed to help prevent diseases and manage chronic conditions.

Market Opportunity

The global health-tech market is expected to grow significantly in the coming years. According to Grand View Research, the market is projected to reach $685.9 billion by 2030, with a compound annual growth rate (CAGR) of 10.4% from 2023 to 2030.

Top 5 FAQs

1. What is Watch Your Health? Watch Your Health is a health-tech startup that provides advanced analytics and personalized recommendations to insurers and pharmaceutical companies.

2. Who led the Series A funding round? Cornerstone Ventures and Conquest Global co-led the Series A funding round.

3. How much funding did Watch Your Health raise? Watch Your Health raised $5 million in its Series A funding round.

4. What does Watch Your Health plan to do with the funding? Watch Your Health plans to use the funding to expand its operations, enhance its technological capabilities, and develop new features.

5. What is the market potential for Watch Your Health? The global health-tech market is expected to reach $685.9 billion by 2030, with a CAGR of 10.4% from 2023 to 2030.

Star cricketer Virat Kohli surprised fans and the sports world on Monday as he announced his retirement from Test cricket with his wife Anushka Sharma by his side at the Mumbai Airport. The couple, who were spotted by paparazzi rushing inside, showed off their chic yet comfortable airport style. In his emotional statement, Kohli thanked the game and the people who have shaped his remarkable journey. Meanwhile, Anushka is currently on a break from Bollywood, but has a film awaiting release.

Every year, the padayatra of Jagadguru Shri Sant Tukaram Maharaj attracts a large number of devotees who travel to Pandharpur to visit the holy site of Lord Vitthal. This year, the 340th Palkhi will depart on June 18 from Shri Shretra Dehugaon and reach Pandharpur on July 6, staying for 4 days. Due to a tithi lapse, the stay at Anthurne has been cancelled. The press conference announcing the details of the padayatra was attended by members of the Sansthan and the program for the ceremony was also revealed.

The ceasefire agreement between India and Pakistan has lifted investor sentiments, leading to a potential 1.9% rally for Indian benchmarks at the opening on Monday. Technical charts suggest that Nifty's next major resistance level is at 23,800, and the reversal of FII outflows will be crucial for a sustained rally. However, analysts caution that volatility may continue until the conclusion of elections.

As per the RBI Holiday Calendar for May 2025, banks will remain closed on May 12 on account of Buddha Purnima. This holiday falls under the Reserve Bank of India's 'Holiday under Negotiable Instruments Act.' Customers planning to visit their nearest bank on May 12 should check if it is open as this holiday only applies to certain states. In addition, there are a total of 12 bank holidays in May 2025, including holidays for Sikkim State Day, the birth anniversary of Kazi Nazrul Islam, and Maharana Pratap Jayanti.

Amidst easing tensions with Pakistan, India's Defence Minister will virtually inaugurate a new BrahMos missile production facility in Lucknow, signaling a major progress for India's defence manufacturing sector. The facility, built at a cost of Rs 300 crore, will have the capacity to produce 80-100 BrahMos supersonic cruise missiles annually, as well as 100-150 next-generation BrahMos missiles. The upgraded variant is lighter and has a longer strike range, making it compatible with aircraft like the Sukhoi. Additionally, the minister will also launch a Titanium and Super Alloys Materials Plant and lay the foundation stone for a Defence Testing Infrastructure System, cementing Uttar Pradesh's position as a major defence manufacturing hub.

On World Red Cross and Red Crescent Day, observed on May 8th to honor the birth of ICRC founder Henry Dunant, the IFRC reported that 28 volunteers have lost their lives while providing aid and assistance to communities in need. This year's theme, "Keeping Humanity Alive," recognizes the selfless and courageous work of these humanitarian workers, who often face great risks in severe and dangerous situations. The day serves as a reminder of their sacrifices and the ongoing need for their vital services. In related sports news, a veteran batter has been called in to replace injured player Devdutt Padikkal on the RCB team.

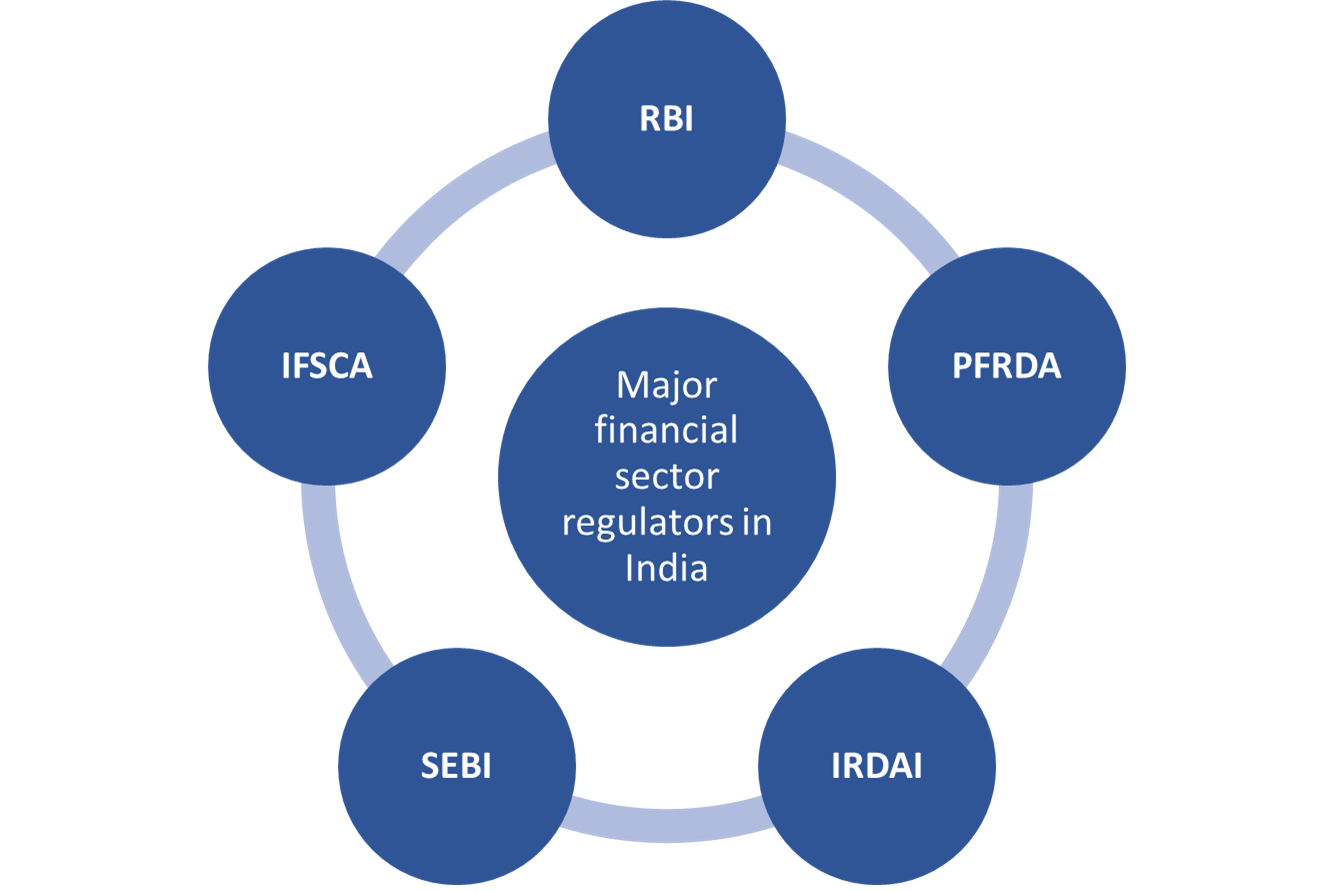

The Reserve Bank of India (RBI) has implemented a new framework for formulating regulations, with an aim to promote transparency and stakeholder engagement. Under the new process, the RBI will publish draft regulations on its official website and allow stakeholders 21 days to provide feedback. The framework also mandates an impact analysis before finalizing any regulation and periodic reviews to ensure its relevance. However, certain regulations may be exempted from the framework in cases where confidentiality or public interest is at stake.

As the stock market opens today, investors will be keeping a close eye on the actions of the Reserve Bank of India and the Supreme Court. RBI's announcement of a ₹50,000 crore OMO (open market operation) as well as the Supreme Court's hearing on the highly debated GST case involving online gaming will significantly impact market movement. Stay updated on these crucial triggers and their effects on stock prices with Stock In News.

Ather Energy, the electric vehicle startup, recently listed at a premium of 2.18% and investors are eager to know the company's future plans. In an exclusive conversation with Zee Business, Ather Energy's co-founder, ED & CTO, Swapnil Jain and CFO, Sohil Parekh reveal the company's future strategies and investments. Ather Energy plans to use the funds raised from its IPO for expanding its manufacturing facilities, R&D efforts, and increasing its footprint in the Indian electric vehicle market. Don't miss this insightful interview for a deep dive into Ather Energy's plans and vision.

After a successful initial public offering, electric two-wheeler maker Ather Energy Ltd listed its shares on the BSE with a premium of 2% over the issue price of Rs 321. However, analysts are cautioning risk-taking investors to hold their positions, citing intense competition and capital risks in the electric two-wheeler market. With a high growth-high competition-high cash burning segment, volatility and risk are expected for short- to medium-term investments in Ather Energy. The company's IPO was subscribed 1.43 times on the closing day, and its market valuation currently stands at Rs 12,110.53 crore.