After years of gaining widespread attention for its reports that caused significant financial losses for Indian billionaire Gautam Adani and his companies, US-based Hindenburg Research has announced its closure. The firm's founder Nate Anderson shared the news with family, friends, and the Hindenburg team, stating that the decision to shut down had been made back in late 2020. This announcement comes at the same time as a call from a Republican Congressman for document preservation, coinciding with the firm's closure.

Hindenburg Research Closes After Exposing Adani Group Fraud

US-based Hindenburg Research, known for its explosive reports that caused significant financial losses for Indian billionaire Gautam Adani and his companies, has announced its closure. The firm's founder, Nate Anderson, revealed the decision to shut down in a statement shared with family, friends, and the Hindenburg team.

Background

Hindenburg Research gained widespread attention in January 2023 with its report on the Adani Group, alleging fraudulent accounting practices and stock manipulation. The report sent shockwaves through the Indian economy, leading to a massive sell-off in Adani shares and wiping out billions of dollars of investor wealth.

Adani Group initially dismissed the allegations but later admitted to accounting errors and withdrew its proposed stock offering. The Securities and Exchange Board of India (SEBI) and the National Stock Exchange of India (NSE) are currently investigating the matter.

Closure Announcement

Anderson's announcement that Hindenburg Research is closing comes at a time when a Republican Congressman has called for document preservation related to the firm. The closure has sparked speculation about potential legal challenges or regulatory actions against Hindenburg.

Top 5 FAQs

1. Why is Hindenburg Research closing? Anderson stated that the decision to shut down was made in late 2020, before the Adani report was published. He cited personal reasons and a desire to pursue other interests.

2. Is Hindenburg Research being investigated? There is no official investigation into Hindenburg Research at this time. However, the firm's closure has raised questions about potential regulatory or legal actions.

3. What will happen to the Adani investigation? SEBI and NSE are continuing their investigations into the Adani Group. These investigations are ongoing, and it is unclear how Hindenburg's closure will affect their progress.

4. Who is Nate Anderson? Nate Anderson is the founder and portfolio manager of Hindenburg Research. He has a background in finance and has been involved in several high-profile investigations.

5. What is Hindenburg Research's track record? Hindenburg Research has a history of publishing reports that have led to significant financial losses for targeted companies. The firm has been criticized for its aggressive tactics, but its track record has also led to calls for greater corporate transparency.

On World Red Cross and Red Crescent Day, observed on May 8th to honor the birth of ICRC founder Henry Dunant, the IFRC reported that 28 volunteers have lost their lives while providing aid and assistance to communities in need. This year's theme, "Keeping Humanity Alive," recognizes the selfless and courageous work of these humanitarian workers, who often face great risks in severe and dangerous situations. The day serves as a reminder of their sacrifices and the ongoing need for their vital services. In related sports news, a veteran batter has been called in to replace injured player Devdutt Padikkal on the RCB team.

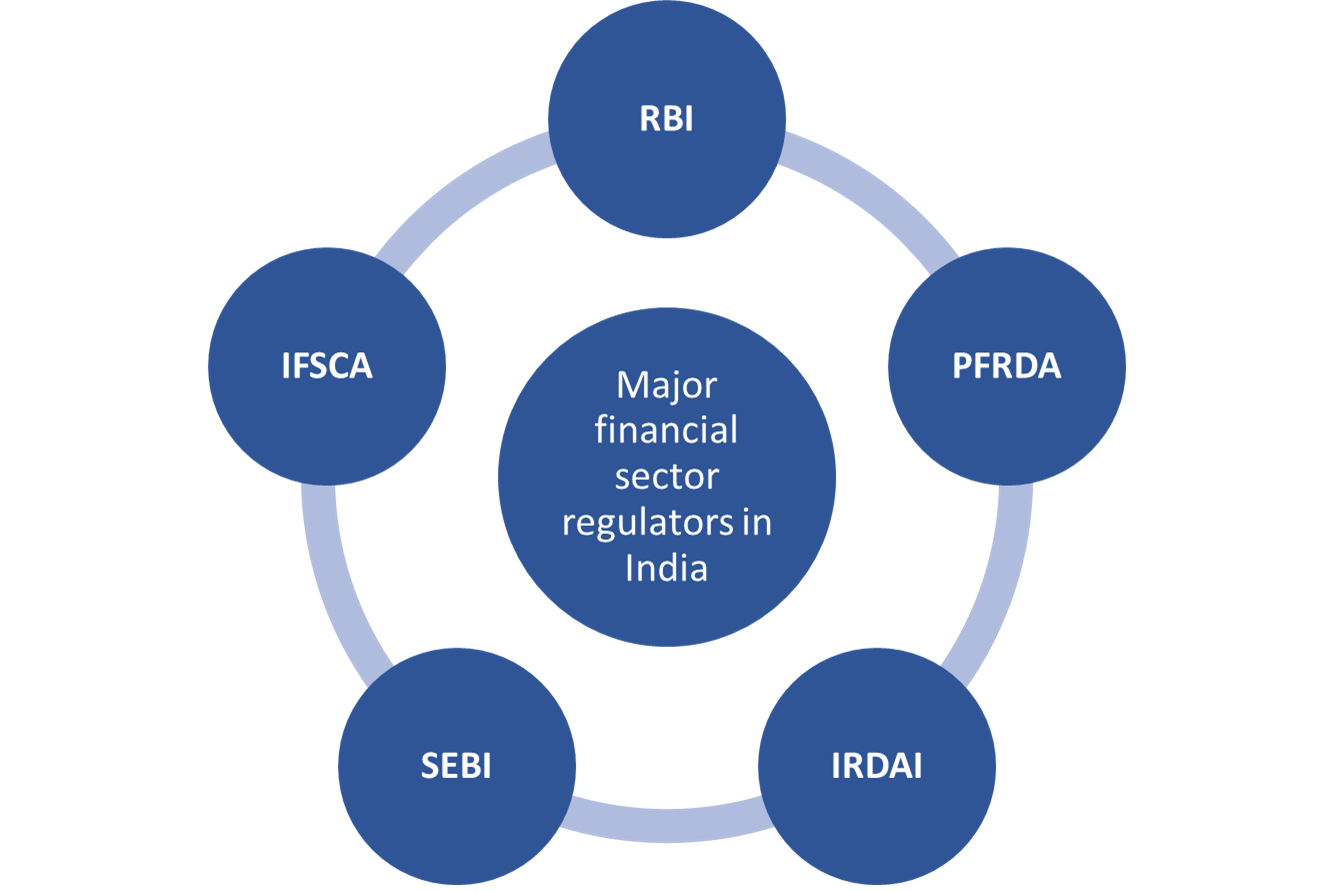

The Reserve Bank of India (RBI) has implemented a new framework for formulating regulations, with an aim to promote transparency and stakeholder engagement. Under the new process, the RBI will publish draft regulations on its official website and allow stakeholders 21 days to provide feedback. The framework also mandates an impact analysis before finalizing any regulation and periodic reviews to ensure its relevance. However, certain regulations may be exempted from the framework in cases where confidentiality or public interest is at stake.

As the stock market opens today, investors will be keeping a close eye on the actions of the Reserve Bank of India and the Supreme Court. RBI's announcement of a ₹50,000 crore OMO (open market operation) as well as the Supreme Court's hearing on the highly debated GST case involving online gaming will significantly impact market movement. Stay updated on these crucial triggers and their effects on stock prices with Stock In News.

Ather Energy, the electric vehicle startup, recently listed at a premium of 2.18% and investors are eager to know the company's future plans. In an exclusive conversation with Zee Business, Ather Energy's co-founder, ED & CTO, Swapnil Jain and CFO, Sohil Parekh reveal the company's future strategies and investments. Ather Energy plans to use the funds raised from its IPO for expanding its manufacturing facilities, R&D efforts, and increasing its footprint in the Indian electric vehicle market. Don't miss this insightful interview for a deep dive into Ather Energy's plans and vision.

After a successful initial public offering, electric two-wheeler maker Ather Energy Ltd listed its shares on the BSE with a premium of 2% over the issue price of Rs 321. However, analysts are cautioning risk-taking investors to hold their positions, citing intense competition and capital risks in the electric two-wheeler market. With a high growth-high competition-high cash burning segment, volatility and risk are expected for short- to medium-term investments in Ather Energy. The company's IPO was subscribed 1.43 times on the closing day, and its market valuation currently stands at Rs 12,110.53 crore.

After moving to a larger space in November, Beyond Boundaries Therapy and Wellness is inviting the public to a free event this Saturday, May 3, to showcase their new location. The clinic will be offering various occupational, physical, and speech therapy services, as well as wellness services for the whole family. Visitors can also participate in fun activities while learning more about the clinic's programs. President and CEO, LaDonna Bannach, hopes the new space will make it easier for families to access different areas of wellness.

The Minister of Investment, Trade and Industry, Datuk Seri Tengku Zafrul Abdul Aziz announced that from tomorrow, the Ministry of Investment, Trade and Industry (Miti) will have full control over Non-Preferential Certificates of Origin (NPCO) for exports to the US. This is to prevent other countries from using Malaysia as a transhipment point to circumvent US tariffs. The government is also committed to upholding the integrity of international trade practices and any attempts to fake declarations will be punished. This comes after reports of China-based brokers rerouting goods through Malaysia and falsely labelling them as Malaysian to avoid US tariffs on Chinese imports.

Mahindra, a leading Indian automotive brand, has been a major success in the SUV market. Its popular Thar lineup, known for its sturdy design and off-roading capabilities, is now set for some changes. According to industry sources, the brand will be phasing out eight variants of the Thar to streamline its lineup. This includes the entry-level AX AWD variant and the open differential AWD LX trims. With the changes, the Thar will now be available in 19 variants ranging from Rs 13.87 lakh to Rs 21.32 lakh.

A Samsung store in Singapore's AMK Hub caught fire this morning, adding to the company's recent string of product-related mishaps. Luckily, the fire was quickly put out by sprinklers and no one was injured. The cause of the fire is still under investigation, but it certainly doesn't bode well for Samsung as they prepare to unveil their highly anticipated Galaxy S8 in New York City on Wednesday. Stay tuned to see if the company can bounce back from this latest setback.

In a surprise announcement, Warren Buffett, the renowned 'Oracle of Omaha', revealed that he will be stepping down as CEO of Berkshire Hathaway and passing the reins to Greg Abel at the end of 2025. The decision, made during the company's annual shareholders meeting, sent shockwaves through the business world, with many global leaders expressing their admiration and well-wishes for Buffett's retirement. However, they also have confidence in Abel to continue the success of the renowned investment company.