As AI technology continues to soar in popularity among investors, companies are adapting to make their shares more affordable. This week, Nvidia completed a forward-stock split, decreasing its share price to 1/10th of its previous value, making it more accessible to everyday investors. With its highly sought-after GPUs driving a 700% increase in stock price since 2023, it's no surprise that Nvidia's board chose to split its stock for the second time in less than a year. Other fast-growing companies like CrowdStrike Holdings, with its shares up over 500% since its IPO in 2019, may also follow in Nvidia's footsteps and conduct stock splits in the near future.

The Rise of AI and the Trend of Stock Splits

In recent years, artificial intelligence (AI) has become a major force in the tech industry, driving innovation in various sectors. This growth has led to increased interest from investors, who are eager to gain exposure to this rapidly growing field.

One noticeable trend that has emerged in the AI industry is the use of stock splits by companies to make their shares more affordable to everyday investors. A stock split involves dividing each outstanding share into a larger number of shares, effectively reducing the share price without impacting the company's overall valuation.

NVIDIA's Stock Split

A notable example of this trend is NVIDIA, a leading manufacturer of graphics processing units (GPUs). On May 23, 2023, NVIDIA announced a 10-for-1 forward stock split, reducing its share price from $318.67 to $31.87. This move marked the second time NVIDIA had split its stock in less than a year, indicating the company's strong growth and increasing shareholder interest.

Since 2023, NVIDIA's stock has surged by over 700%, driven by the high demand for its GPUs in gaming, artificial intelligence, and other applications. The stock split makes it easier for smaller investors to participate in NVIDIA's growth story by reducing the per-share cost of ownership.

Other Companies Following Suit

NVIDIA is not alone in its decision to split its stock to improve affordability. Several other fast-growing companies in the AI space have made similar moves:

FAQs on Stock Splits

1. What is the purpose of a stock split? A stock split reduces the share price without affecting the company's overall valuation. It makes shares more affordable and accessible to smaller investors.

2. How does a stock split affect the number of shares I own? If you own 100 shares before a 10-for-1 split, you will have 1,000 shares after the split.

3. Does a stock split make my shares more valuable? No, a stock split does not change the value of your investment. The value of your portfolio remains the same as it was before the split.

4. Can a stock split be reversed? A stock split can be reversed, but this is a rare occurrence. A reverse stock split involves combining multiple shares into a smaller number of shares, increasing the share price.

5. Why do companies split their stocks? Companies may split their stocks to improve liquidity, make shares more accessible to investors, or as a sign of confidence in the company's future growth.

On World Red Cross and Red Crescent Day, observed on May 8th to honor the birth of ICRC founder Henry Dunant, the IFRC reported that 28 volunteers have lost their lives while providing aid and assistance to communities in need. This year's theme, "Keeping Humanity Alive," recognizes the selfless and courageous work of these humanitarian workers, who often face great risks in severe and dangerous situations. The day serves as a reminder of their sacrifices and the ongoing need for their vital services. In related sports news, a veteran batter has been called in to replace injured player Devdutt Padikkal on the RCB team.

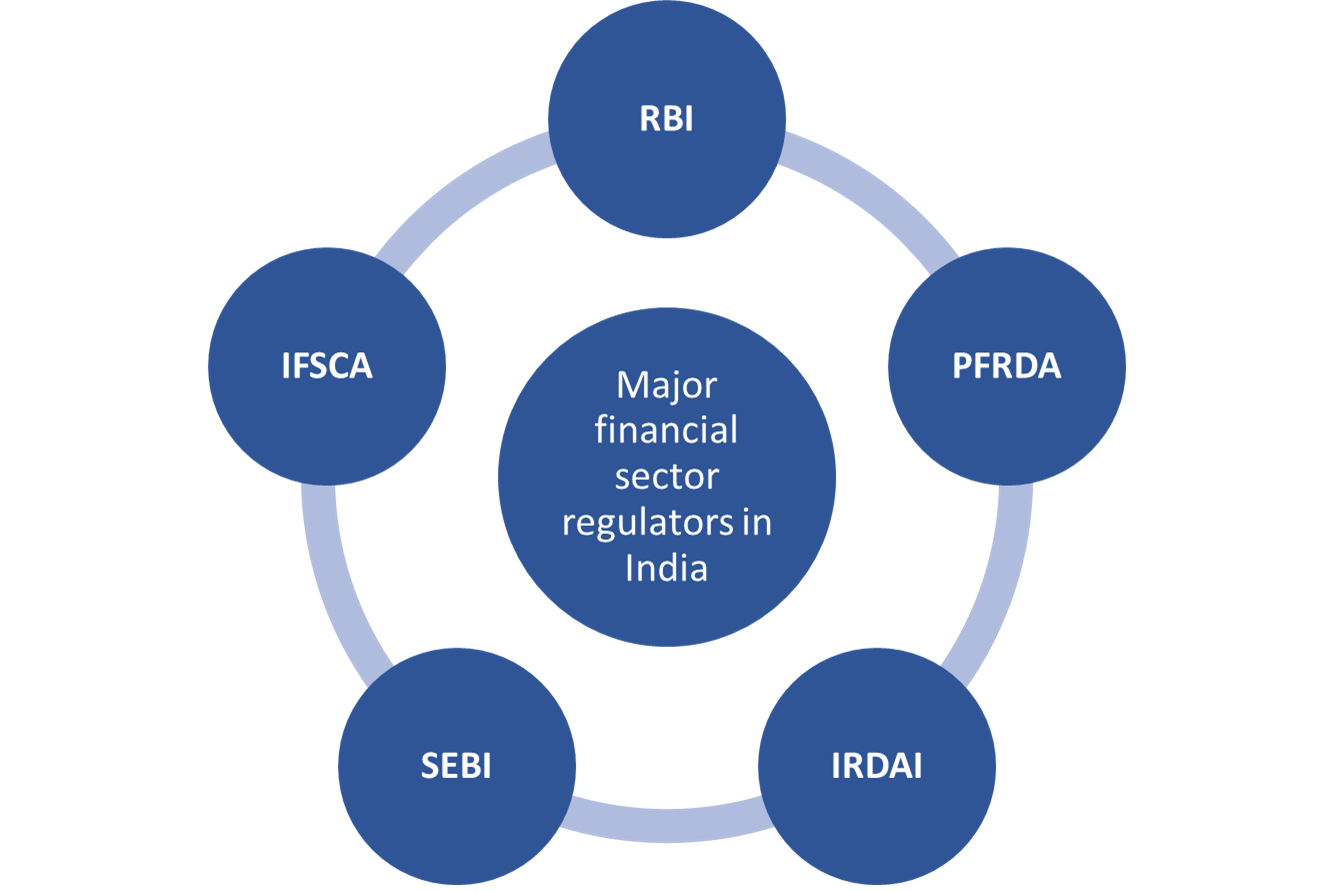

The Reserve Bank of India (RBI) has implemented a new framework for formulating regulations, with an aim to promote transparency and stakeholder engagement. Under the new process, the RBI will publish draft regulations on its official website and allow stakeholders 21 days to provide feedback. The framework also mandates an impact analysis before finalizing any regulation and periodic reviews to ensure its relevance. However, certain regulations may be exempted from the framework in cases where confidentiality or public interest is at stake.

As the stock market opens today, investors will be keeping a close eye on the actions of the Reserve Bank of India and the Supreme Court. RBI's announcement of a ₹50,000 crore OMO (open market operation) as well as the Supreme Court's hearing on the highly debated GST case involving online gaming will significantly impact market movement. Stay updated on these crucial triggers and their effects on stock prices with Stock In News.

Ather Energy, the electric vehicle startup, recently listed at a premium of 2.18% and investors are eager to know the company's future plans. In an exclusive conversation with Zee Business, Ather Energy's co-founder, ED & CTO, Swapnil Jain and CFO, Sohil Parekh reveal the company's future strategies and investments. Ather Energy plans to use the funds raised from its IPO for expanding its manufacturing facilities, R&D efforts, and increasing its footprint in the Indian electric vehicle market. Don't miss this insightful interview for a deep dive into Ather Energy's plans and vision.

After a successful initial public offering, electric two-wheeler maker Ather Energy Ltd listed its shares on the BSE with a premium of 2% over the issue price of Rs 321. However, analysts are cautioning risk-taking investors to hold their positions, citing intense competition and capital risks in the electric two-wheeler market. With a high growth-high competition-high cash burning segment, volatility and risk are expected for short- to medium-term investments in Ather Energy. The company's IPO was subscribed 1.43 times on the closing day, and its market valuation currently stands at Rs 12,110.53 crore.

After moving to a larger space in November, Beyond Boundaries Therapy and Wellness is inviting the public to a free event this Saturday, May 3, to showcase their new location. The clinic will be offering various occupational, physical, and speech therapy services, as well as wellness services for the whole family. Visitors can also participate in fun activities while learning more about the clinic's programs. President and CEO, LaDonna Bannach, hopes the new space will make it easier for families to access different areas of wellness.

The Minister of Investment, Trade and Industry, Datuk Seri Tengku Zafrul Abdul Aziz announced that from tomorrow, the Ministry of Investment, Trade and Industry (Miti) will have full control over Non-Preferential Certificates of Origin (NPCO) for exports to the US. This is to prevent other countries from using Malaysia as a transhipment point to circumvent US tariffs. The government is also committed to upholding the integrity of international trade practices and any attempts to fake declarations will be punished. This comes after reports of China-based brokers rerouting goods through Malaysia and falsely labelling them as Malaysian to avoid US tariffs on Chinese imports.

Mahindra, a leading Indian automotive brand, has been a major success in the SUV market. Its popular Thar lineup, known for its sturdy design and off-roading capabilities, is now set for some changes. According to industry sources, the brand will be phasing out eight variants of the Thar to streamline its lineup. This includes the entry-level AX AWD variant and the open differential AWD LX trims. With the changes, the Thar will now be available in 19 variants ranging from Rs 13.87 lakh to Rs 21.32 lakh.

A Samsung store in Singapore's AMK Hub caught fire this morning, adding to the company's recent string of product-related mishaps. Luckily, the fire was quickly put out by sprinklers and no one was injured. The cause of the fire is still under investigation, but it certainly doesn't bode well for Samsung as they prepare to unveil their highly anticipated Galaxy S8 in New York City on Wednesday. Stay tuned to see if the company can bounce back from this latest setback.

In a surprise announcement, Warren Buffett, the renowned 'Oracle of Omaha', revealed that he will be stepping down as CEO of Berkshire Hathaway and passing the reins to Greg Abel at the end of 2025. The decision, made during the company's annual shareholders meeting, sent shockwaves through the business world, with many global leaders expressing their admiration and well-wishes for Buffett's retirement. However, they also have confidence in Abel to continue the success of the renowned investment company.