As Diwali approaches, customers of the Punjab State Cooperative Bank are in for a treat with the announcement of zero processing charges on all major loans. This festive offer, introduced by Chief Minister Bhagwant Singh Mann, is aimed at stimulating economic activity and enabling customers to celebrate the upcoming festivals without any financial burden. The offer will be valid for a limited period from October 15 to November 15, 2024 and applies to personal, consumer, and vehicle loans at all 18 branches of the bank in Chandigarh. With this initiative, the state government is reaffirming its commitment to boost the cooperative sector and provide affordable financing options to its citizens.

Punjab State Cooperative Bank Offers Diwali Delight with Zero Processing Charges on Loans

As the festive season of Diwali draws near, the Punjab State Cooperative Bank (PSCB) has announced a special offer for its customers, offering zero processing charges on all major loans. This move, announced by Chief Minister Bhagwant Singh Mann, is aimed at stimulating economic activity and alleviating financial burdens for customers during the upcoming celebrations.

Background

The Punjab State Cooperative Bank has a long-standing history of supporting the cooperative sector in the state. Established in 1957, it operates through 18 branches in Chandigarh and provides various banking services, including loans to individuals and businesses.

Diwali Loan Offer Details

The zero processing charges offer will be valid from October 15 to November 15, 2024. It applies to personal loans, consumer loans, and vehicle loans. Customers can avail this offer at any of the 18 PSCB branches in Chandigarh.

Benefits to Customers

This offer provides significant savings for customers who are planning to take out loans during the festive season. Processing charges typically range from 1% to 3% of the loan amount, which can translate into substantial savings.

Government's Commitment

The Punjab government's decision to introduce this offer reflects its commitment to boosting the cooperative sector and providing affordable financing options to its citizens. The government recognizes the role of cooperatives in promoting economic development and empowering local communities.

FAQs

1. What types of loans are eligible for the zero processing charges offer? A: Personal loans, consumer loans, and vehicle loans are eligible.

2. How long will the offer be valid? A: The offer will be valid from October 15 to November 15, 2024.

3. Is there a minimum loan amount requirement? A: No, there is no minimum loan amount requirement.

4. Can I apply for multiple loans under this offer? A: Yes, you can apply for multiple loans, but each loan will be subject to processing charges if it falls outside of the offer period.

5. Are there any other conditions or restrictions on the offer? A: The offer is applicable to new loans only and is subject to the bank's terms and conditions.

After losing major businesses to bankruptcy, Anil Ambani's Reliance Group faced yet another threat when its subsidiary, R-Infra, faced insolvency proceedings. However, the National Company Law Appellate Tribunal (NCLAT) has suspended the order, providing a much-needed sigh of relief for the group. This comes as the group tries to rebuild its assets in the renewable energy and defence sectors, with plans to generate significant revenue from exports.

Tata Motors is adding two new special edition vehicles to their SUV lineup: the Curvv Dark and Curvv EV Dark. These top-tier trims will come with a variety of engine options and a larger battery pack for the EV version. Tata is well-known for their Dark editions, which have been featured on previous models such as the Nexon EV, Harrier, and Safari. This time, Tata is also using the Curvv to make an appearance in the upcoming IPL 2025 tournament. But how does the Curvv stack up to its rival Kushaq in terms of performance? We take both vehicles for a test drive to find out. If you're not sold on the idea of an electric SUV like the Creta, here are some pure-combustion options that might interest you.

In a four-hour podcast with media outlet, armed fugitive Vijay Mallya claimed that the Indian government has already recovered more than twice the amount owed to banks by infamous airline, Kingfisher. He questioned why he continues to be labelled a "fraud" or "thief" despite this fact and stated he would "seriously consider" returning to India if given a fair trial and a "dignified existence". Mallya also shared his perspective on the downfall of Kingfisher Airlines, pinning the blame on government policies and seeking permission from then Finance Minister Pranab Mukherjee to downsize the airline.

Family Magic is a must-see performance for all ages, combining audience interaction, comedy, and visual magic. Magician Bill Blagg is not only providing entertainment, but also paying homage to his great grandfather and the books that inspired his love for magic. Tickets are now on sale for the performance at the Reg Lenna Center for The Arts in Jamestown, New York.

Indian Railways is all set to launch its new Vande Bharat Express train service on the Srinagar-Katra route, connecting the Kashmir Valley with the holy pilgrimage site of Katra. The service will run six days a week and feature onboard modern facilities, providing a faster, more comfortable, and efficient journey for passengers. This launch coincides with the inauguration of the country's highest railway arch bridge by PM Modi on Friday, marking a major milestone in the completion of the Udhampur-Srinagar-Baramulla Rail Link project. Plans for a new Delhi-Srinagar Vande Bharat service with sleeper coaches are also in the works. This development is expected to boost connectivity and tourism in Jammu and Kashmir, while also showcasing India's progress in modern rail infrastructure.

The recently renamed Eternal Ltd, formerly known as Zomato, reported a significant year-on-year decline in net profit for the March 2025 quarter. While revenue was in line with expectations, the company's operating performance fell below Street estimates. Despite this, analysts are divided on the company's outlook, citing increasing competition in the quick commerce sector and challenges at Blinkit due to expansion.

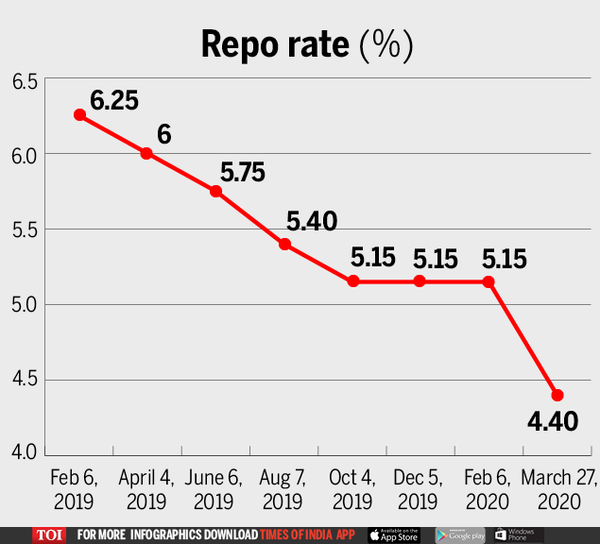

In its second bi-monthly monetary policy review for the fiscal year 2025-26, the Reserve Bank of India (RBI) has announced a significant 100 basis points reduction in the Cash Reserve Ratio (CRR), bringing it down to 3%. This move aims to boost liquidity and credit growth in the economy. The phased implementation of this reduction, as well as the 50 bps cut in the repo rate and other interest rates, has been well received by analysts and investors. Pranay Aggarwal, a Director and CEO of a discount brokerage firm, has praised the RBI's policy as bold and growth-oriented, with the potential to support the economy and instill confidence in India's macroeconomic fundamentals.

From his lavish lifestyle to legal battles, Vijay Mallya speaks out in an exclusive podcast with Raj Shamani. Learn more about his favourite cars, the infamous Kingfisher tune, and why he believes he's been unfairly targeted by the media. Plus, a condensed version of the 4-hour episode for those lacking patience.

JD Vance, the Vice President of a major company, shared a cryptic jab towards the sensational fallout between Donald Trump and Elon Musk. In a recent Instagram post, he joked about the highly publicized bromance between the two prominent figures and hinted at an upcoming interview discussing the drama on Von's podcast. This marks the first time Vance has spoken out about the rift between the former political allies, adding to the ongoing speculation and interest surrounding the situation.

The RBI's decision to slash the repo rate by 50 basis points is welcome news for borrowers as it will lead to a decrease in their EMIs. This marks the third interest rate cut by the central bank since the COVID-19 pandemic. With the current repo rate standing at 5.50 percent, borrowers can expect home loans, auto loans, and personal loans to be more affordable.