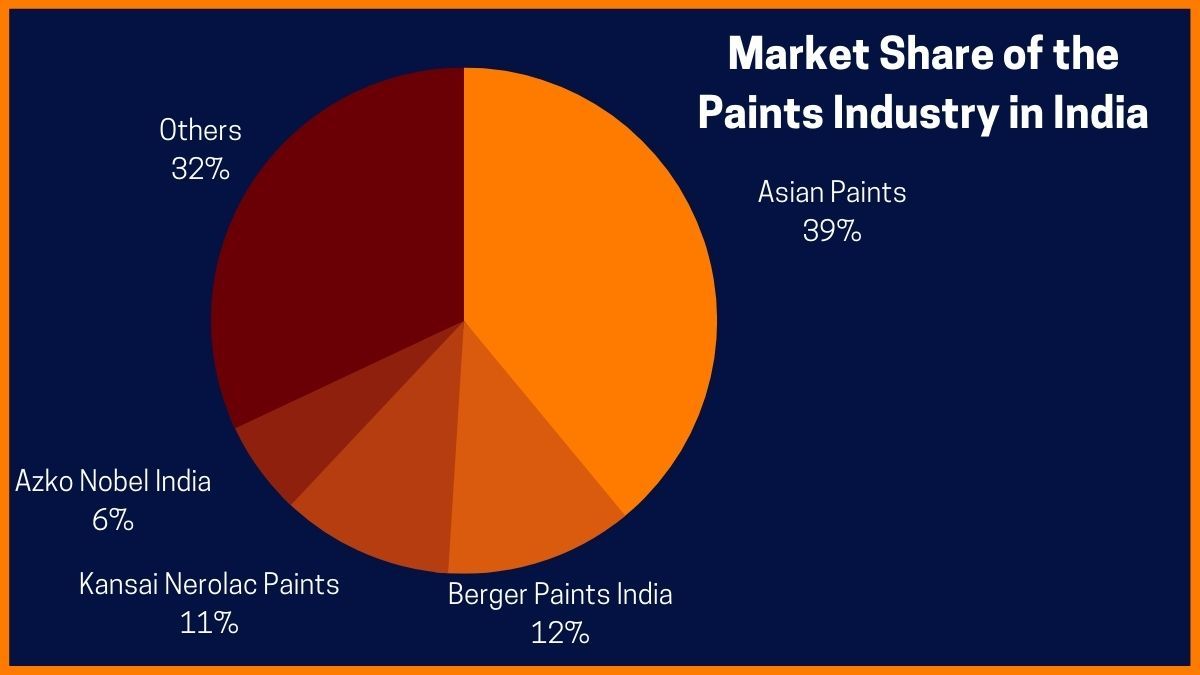

The highly popular Indian paint company, Asian Paints, has seen a sharp decrease in its stock price by over 26 percent from its peak in September 2024. The disappointing underwhelming performance of Q2FY25 has led to several brokerages expressing their disappointment and concerns over increased competition and challenging market conditions. With a technical fall of over 20 percent, the stock is likely to witness a negative trend in the future, indicating a bear market. In the near term, traders can expect limited upside and potential support levels at Rs 2,125 and Rs 2,315. JP Morgan has downgraded the stock and cut its target price, raising questions for investors.

Asian Paints Faces Downturn: Stock Price Plummets by over 26%

Introduction:

Asian Paints, the leading paint company in India, has been experiencing a significant decline in its stock price since September 2024. The company's disappointing performance has raised concerns among investors and brokerages alike.

Background:

In September 2024, Asian Paints reached its peak stock price. However, since then, the stock has fallen by over 26%. The underperformance was attributed to the company's lackluster Q2FY25 results, which were below analysts' expectations.

Key Factors Contributing to the Decline:

Analysts have cited several factors that have contributed to Asian Paints' stock price decline:

Future Outlook:

Technical analysis suggests that Asian Paints' stock is likely to continue its negative trend. The stock has fallen by over 20% since its peak, indicating a bear market. Traders can expect limited upside in the near term, with potential support levels at Rs 2,125 and Rs 2,315.

Top 5 FAQs and Answers:

Q1. Why has Asian Paints' stock price declined so much? A1. The stock price decline is due to a combination of factors, including increased competition, challenging market conditions, and a downgrade by JP Morgan.

Q2. Is Asian Paints a good investment now? A2. With the stock in a bear market, investors may want to adopt a cautious approach before investing in Asian Paints.

Q3. What are the key risks to Asian Paints' business? A3. The company faces risks from increased competition, rising costs, and economic headwinds.

Q4. What is the expected future outlook for Asian Paints? A4. Technical analysis suggests a negative trend, with limited upside and support levels at Rs 2,125 and Rs 2,315.

Q5. What should investors do if they own Asian Paints shares? A5. Investors should monitor the situation and consider their risk tolerance before making any decisions. They may want to seek professional advice.

In response to complaints about high prices and unreliable services from popular private cab aggregators, the Central government is launching a new cab-hailing platform called 'Bharat Taxi'. This initiative aims to provide commuters in Delhi with a transparent and fixed pricing system, while also offering a more driver-friendly revenue model. The app has already received a high response from drivers and will offer a variety of transportation options. Stay updated with the latest news on News24 and social media platforms.

As market participants eagerly await the Union Budget of 2025, eyes are on Finance Minister Nirmala Sitharaman for potential relief in the form of abolishing the Securities Transaction Tax (STT) and raising the exemption limit for long-term capital gains (LTCG) tax. Concerns have been raised over the increased taxation burden on equity and index traders, leading to a demand for complete abolition of STT. With recent amendments increasing the LTCG tax from 10% to 12.5%, there is hope that the threshold limit for LTCG could be raised to Rs 2 lakh or higher, encouraging more retail participation in the equity market.

The Bihar State Power Generation Company Limited (BSPGCL) has signed Memorandums of Understanding (MoUs) with private developers to establish pumped storage power projects worth Rs 13,000 crore in Nawada district. This initiative, under the state's Pump Storage Project Promotion Policy, will add 2,120 MW of renewable energy to support grid stability. The move aligns with the Bihar government's plan to attract Rs 50 lakh crore for economic growth and job creation in the next five years.

Following the National Company Law Tribunal's approval of Vedanta Limited's demerger scheme, its shares hit a 52-week high of Rs 579.95. The demerger, which will result in four independent listed companies, aims to create focused, world-class entities aligned with India's growth ambitions. With this move, Vedanta group will now consist of five listed companies, each with the potential for growth and attracting strategic investments. Chairman Anil Agarwal sees this as a step towards sustainable growth and empowerment of leadership across all entities.

The IPL 2026 auction saw Mumbai Indians and Punjab Kings making strategic moves as they retained key players and acquired new talent for the upcoming season. Notable retentions for Mumbai Indians included star players Rohit Sharma and Jasprit Bumrah, while Punjab Kings kept their core intact with the likes of Shreyas Iyer and Yuzvendra Chahal. Both teams also made smart signings in the auction, with Mumbai Indians adding promising players like Danish Malewar and Quinton de Kock while Punjab Kings brought in young talent like Arshdeep Singh and Harpreet Brar. Fans can expect an exciting season from these powerhouse franchises in the year 2026.

The Delhi High Court has ordered the Union Bank of India to explain their actions in declaring industrialist Anil Ambani's son's company's account as fraudulent without issuing a show cause notice or giving him an opportunity to respond. The Court has raised concerns over the violation of natural justice and will further hear the case on December 19. This move by the bank goes against the Supreme Court's decision in a similar case and has resulted in the CBI filing cases against the Ambani group companies for causing a loss of nearly ₹14,853 crores to the bank.

Punjab Kings made some strategic moves at the IPL 2026 mini auction in Abu Dhabi, securing the services of four players with a budget of Rs 11.50 crore. They used Rs 8 crore to sign two Australian all-rounders, Cooper Connolly and Ben Dwarshuis, aiming to fill the gap left by Glenn Maxwell's departure. The franchise also made a smart move by bringing back uncapped Indian spinner Pravin Dubey and signing another newcomer, Vishal Nishad, for Rs 30 lakh each.

At the IPL 2026 auction in Abu Dhabi, Chennai Super Kings secured a major deal by snapping up promising wicketkeeper Kartik Sharma for an eye-popping amount of ₹14.20 crore. The bidding war started at his base price of ₹30 lakh, but quickly escalated between CSK and Kolkata Knight Riders, eventually reaching the massive sum. The 19-year-old's impressive talents have made him one of the most sought-after players in the auction, as CSK makes a bold investment in his future.

Kirloskar Oil Engines, a Pune-based company, has secured a project sanction order for the development of a 6MW medium speed marine diesel engine, with majority funding from the central government. This win highlights the potential for indigenous content and self-reliance in marine engine development, a key focus for the Indian government. The engines will be used in Indian Navy and Indian Coast Guard ships, reducing the reliance on imports and making strides towards self-sufficiency in this sector.

In an effort to accelerate industrial development in Tamil Nadu, Chief Minister M K Stalin has spearheaded the 'TN Rising' Investors Conclave, resulting in the signing of 91 Memorandums of Understanding (MoUs) worth Rs 36,660.35 crore. This initiative has not only attracted significant investments but also created 56,766 job opportunities across the state. With a strong focus on upgrading the state's economy, Tamil Nadu continues to attract investments through its investment promotion and industrial expansion efforts, with the aim of becoming a USD 1 trillion economy by 2030.